That 70's Market

The stock market has gone nowhere for about 12 years, but before this long funk, stocks doubled in just three years – a run that was the cherry on top of a 20-year bull market sundae.

After this long plateau, inflation fears abound, oil prices remain uncomfortably high after skyrocketing a few years before. A global superpower is stuck in a war in Afghanistan, and Iraq is a war zone putting global oil supplies at risk. We have no idea where economic growth will come from, or when it will kick in. The government is a mess. Tax and regulatory uncertainty has business leaders scratching their heads. The unemployment rate, no longer stable at around 5%, seems to be heading toward 10%, and investing in precious metals or the far east appears to be the only way to make any money.

This "New" normal could describe today’s market. Or the early 1980’s.

From around 1942 to 1966, the stock market gained around 1,000%, not including hefty dividends. The market then essentially went sideways for more than a decade, with some big slides along the way that made the concept of owning stocks seem risky and pointless. From that point of maximum bummerness in the early 1980’s, a new near 20-year bull market began that carried stocks up 15-fold without dividends, including a good chunk made in those final exuberant years. Today, we’re only up just over 10-fold (without dividends) from the stock market levels we saw at the end of the 70's malaise.

In fact, going nowhere for a decade or more is sort of the norm for the stock market, although it experiences huge runs in between the great plateaus. Is this because innovation runs in cycles? Probably not. Nor does it have much to do with government mishandling of the economy, or global uncertainty, or any number of geo-political-macro-whatever reasons.

The likely reason – assuming there actually is a pattern and not simply a multi-decade coincidence – is that investors swing from hating stocks, irrationally so, to loving them, again irrationally so. We go from undervaluing stocks to wildly overpaying for them by the end of these possible confidence supercycles.

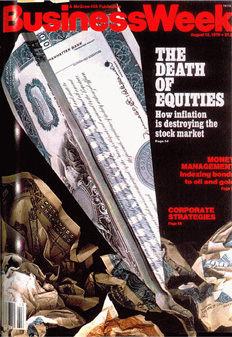

Single digit P/Es and high dividend yields slowly become sky-high P/Es and minimal dividends. Investors go from caring little about investing to chatting about it with co-workers, watching financial TV programs, looking for hot stock picks, and – and this is what we watch – loading up the truck to buy mutual funds. In 1980, you couldn’t give away a stock mutual fund, unless it invested in gold. And why not? BusinessWeek wrote the famous The Death of Equities article in late 1979, a cover story illustrated by a crashing plane crafted from a paper stock certificate.

Single digit P/Es and high dividend yields slowly become sky-high P/Es and minimal dividends. Investors go from caring little about investing to chatting about it with co-workers, watching financial TV programs, looking for hot stock picks, and – and this is what we watch – loading up the truck to buy mutual funds. In 1980, you couldn’t give away a stock mutual fund, unless it invested in gold. And why not? BusinessWeek wrote the famous The Death of Equities article in late 1979, a cover story illustrated by a crashing plane crafted from a paper stock certificate.

If you want to know what a good long-term entry point into stocks feels like, read the old BusinessWeek article and keep in mind how all of the "alternatives" offered up as better than stocks became losers, while stocks were about to begin their greatest boom ever.

Seeing stocks plateau following a period of overexuberance isn’t something we just started thinking about today after a decade of crummy performance. In fact, here's an example of one of the many times I've mentioned the fear of a 70's decade… this one from about a decade ago.

From the article:

“Jonas Max Ferris, founder of Maxfunds.com, also thinks this market suffers from some of the same problems the 70's did. He points out that while corporate earnings actually grew in the 1970's, stock prices went nowhere, because prior to the 70's, investors had paid too much for those "nifty fifty" stocks they felt they had to own. Similarly, investors in the 90's drove prices on large cap stocks up so far that even with earnings growth, those stocks are still too expensive to attract buyers in this decade, and the same big conglomerates are issuing too much debt, the same way they did back then.”

You’ll note the mention of an international bond fund pick, American Century International Bond (BEGBX), which we owned at that time in our newsletter and eventually in client accounts. You’ll also note we produced a 150% return since inception (April 2002) in our Aggressive Portfolio, largely by avoiding the large cap stock malaise of the early part of the decade. But we’re not going to be able to deliver a big return going forward by avoiding the U.S. stock market anymore.

On this long term Dow chart that highlights the dead money periods, you’ll see periods of strong growth along with flatter periods. Ideally, stocks would go up more in line with our real corporate growth and future prospects, but in reality, they don’t. We get flat performance, and then years of high performance; investment advocates only declare "over time, the market delivers X%” when discussing long-term returns. It actually delivers near-zero for long periods, and then much more than X% during others.

We don’t know exactly when this malaise will end. The market picked up in 1980 for a run of more than 30% only to sink again by 1982 as the government attempted to kill inflation. We could have a few more false starts, but longer-term stocks are going to beat everything else, just as they have following every long period of go-nowhere returns in the past. The fact that mutual fund investors are now abandoning stock funds all but guarantees the return of stock outperformance in the long-run.

Ideally, we’d like to see a large chunk of the investing business disappear in order to call a true bottom of a new multi-decade bull market, much like we saw in 1932 and 1980. We almost experienced this a few years ago, but the government propped up the banks and Wall Street. 2009 might have been our 1975 low – a good entry point, but still several years before the next great stock expansion. When the Dow slipped below 7,000 briefly in early 2009, it was probably on its way to 5,000 – more like the 1929-1932 market, and low enough to end the careers of many in the money management business. At that level, big money would have been made by the remaining players over the next two decades. But we didn’t get that, and today stocks are merely better-priced compared to the alternatives, and not likely to deliver double-digit annualized returns over a decade-plus.

But who knows? America tends to prove the doomsayers wrong. There are always reasons why our country is supposedly losing the lead in the world economy, especially following a period of bad returns and a faltering economy. Declinism is popular now, and that usually means a period of American Exceptionalism is just around the corner, much like the tendency for boom predictions to come near the end of a boom. Would That Used to Be Us by Thomas L Friedman ("How America fell behind in the world it invented") been a NY Times Best Seller in 1999? Of course not. People were too busy buying Dow 36,000 or even worse, The Roaring 2000s.

That doesn’t mean you should expect 15% returns in the market every year for the next decade. In all likelihood, it does mean stocks will be your best bet, beating other categories by as much as they ever have during good times – perhaps 2-5% a year better than bonds, cash, or real estate. They'll kill commodities, gold, and other ill-fated "alternative" investments and beat most countries supposedly eating our lunch. America will have to become a growth engine again.

But has it ever stopped? We’ve created more brand-new, from scratch multi-billion dollar companies since the market stopped going up 12 years ago than probably all other countries combined. Google started in 1998, and what about Facebook, Groupon, etc.? Amazon – which started in the 1990s - has a greater market value than McDonalds – itself one of the world’s great growth stories. The recent passing of Steve Jobs should remind us that Apple – perhaps the greatest growth story of all time – began during that decade-long funk in the 1970's. Yet investors gave up on stocks then to focus on shiny metal pulled from the ground and worry about America’s decline.